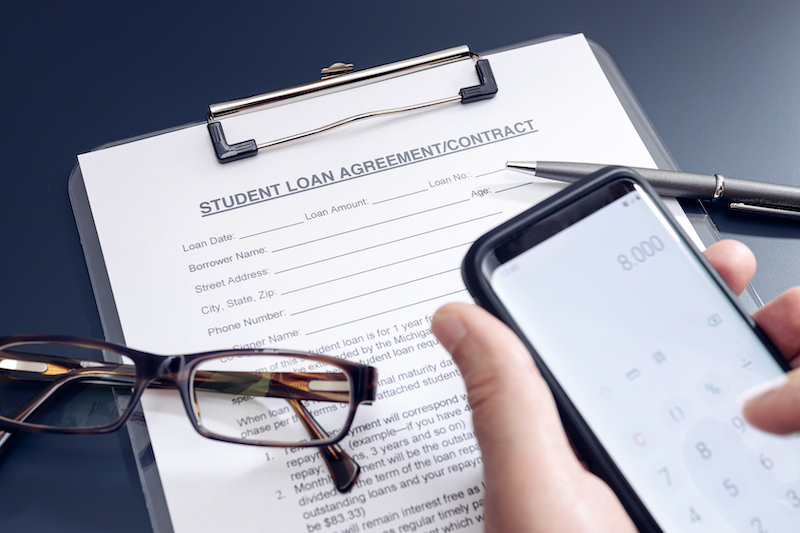

The prospect of forgiving student loan debt has been in the news a lot lately, with people vigorously arguing both sides of the debate. We aren’t here to add our voice to the fray; instead, we’re going to look at how these shifts in policy may impact students who are currently applying to college, or who will be soon.

We’ve written about financial aid before (a few times), as college is quite expensive, and the cost is one of the more important factors in college strategy for many students. However this decision goes, it will impact college strategy for many students, so in this article, we’ll examine the possible ramifications of debt relief, and how you can make the best use of any changes which occur.

As a warning, at the time of writing of this article (May 9th), there are no decisions yet for if, when, or in what way student debt relief may occur. While our expertise allows us to make educated predictions about impacts, know that the future is uncertain and that we do not know for certain how this will unfold. That said, let’s jump in.

The Current Position

Mandatory repayments and interest on student loans were put on hold due to the Coronavirus pandemic. This pause has been extended several times, with the current pause set to expire on August 31st. President Biden has also offered some limited forgiveness programs to certain borrowers but has thus far not made any announcements of wide-scale debt relief.

There are several different plans or possibilities being floated currently. The most popular are:

- General relief. The US government forgives all currently outstanding loan balances.

- Limited but widespread relief. The US government forgives a portion of all outstanding loan balances. The most common proposals are $10,000 or $50,000, available to all borrowers.

- Means-based relief. The US government forgives up to $50,000 of debt for students earning below a certain income threshold.

- No forgiveness. The pause expires, and everything continues as it was before.

- Unending pause. The pause in interest and mandatory payments keeps getting extended indefinitely, with no actual action taken on debt forgiveness.

So what happens to current applicants under these plans, and how will it impact you?

Current Proposals

There are a number of proposals in the works which can impact students applying to colleges going forward. We’ll go over these, and explain how they may impact you.

Free or Lowered Tuition

There have been several proposals to make community college or in-state universities free or reduced prices significantly for students earning under a certain threshold. While some states have made moves in this direction, there is currently no federal plan to make this happen broadly.

Public Service Loan Forgiveness

While the Public Service Loan Forgiveness (PSLF) program has been active for some time, there are proposals to expand the scope and scale of the program and to allow additional borrowers to take part. This would allow even more students who enter public service jobs to discharge their loans.

Bankruptcy Reform

Currently, borrowers are unable to discharge student loans through bankruptcy. There are proposals to reform this process in some ways, though it is uncertain currently what form this may take.

How This Will Impact You

Almost all of the arguments and proposals apply to extant college debt, with only a few proposals that would impact students who are currently applying to colleges. This is because, as high school students, you are unable to vote for the most part, and so politicians feel no drive to cater to your interests.

The proposal for lowered or free in-state tuition may help some students who attend public colleges and can impact strategy. It is, however, merely a continuation of current trends; public in-state colleges are already far cheaper than private or out-of-state alternatives. This new proposal will simply make them even more appealing, but will not alter the underlying strategy for applying in-state or to community colleges.

The expansion of public service loan forgiveness can impact considerations for majors. Most public service fields are low-paying, and the majors which feed into them are often far less popular. If these careers become a more viable option, then the majors may increase in popularity, though many of these careers are highly self-selecting.

Overall, however, much of this won’t affect you one way or another as the current debate stands. This is irritating, and understandably so. After all, in another thirty years, you’ll be the ones running the show, so shouldn’t you get a chance to impact what it will look like when you take the reigns?

If this (or any other policy) is a matter of interest to you, we recommend getting involved politically. Write letters to your local and state representatives. Form clubs at your school to advocate for policy issues. Join existing nonprofits that seek to lobby for political positions.

This will allow you to have an impact here and now on policy decisions. It will also look great on college applications; colleges love to see that students are passionate enough about an issue to take action on it, and political advocacy is a cornerstone of the US collegiate experience.

We’ve helped a number of students get involved with their local politics, advocating for policy positions, joining Houston’s Mayor’s Youth Advisory Council, and leading demonstrations of their fellow students to support causes. If you are interested in learning more about how we can help you get involved, check out our Candidacy Building page.

A Warning

It is uncertain what, if anything, will happen involving student debt forgiveness. Indeed, even if it does occur, it seems likely this will be a solitary event (though this too is uncertain). Therefore, we caution you against making future plans based on the idea that the student loans you take out now will be forgiven in the future.

The safest way to plan for the future is to assume that everything will continue as it has regarding student loans and college payments. While this may not be appealing, it will save you from a disaster if you assume otherwise and are proven wrong. Expecting the best and preparing for the worst is the best way to make sure you are set no matter what the eventual outcome is.

Final Thoughts

Student loan forgiveness is a contentious subject, with proponents and critics each advancing numerous arguments on the subject. Regardless of what ends up being decided, the period of interest abeyance has shaped the broader discourse around college education, and there will be longer-term effects stemming from it.

While we don’t yet know what those impacts will be, we know that college applications will still continue to weigh upon applicants, as the other impact of the pandemic has been a startling increase in the number of students applying to college and a corresponding drop in admissions rates.

If you want help applying to college, or want to learn more about how we can help you build your candidacy, schedule a free consultation today. We have helped hundreds of students throughout Houston and around the world get into their top schools, and we’re always happy to hear from you.